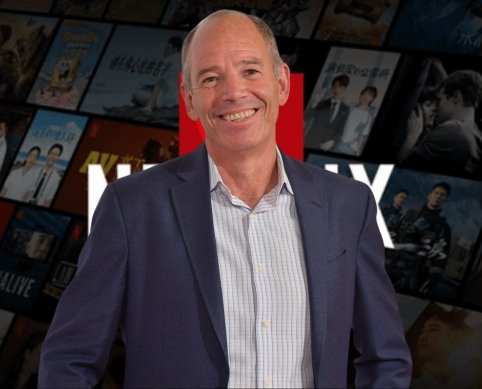

Infosys plans to pursue additional acquisitions following its recent technology deals, according to CEO Salil Parekh

Following two acquisitions this year, Infosys, India’s second-largest IT services company, is actively seeking more opportunities and is open

Following two acquisitions this year, Infosys, India’s second-largest IT services company, is actively seeking more opportunities and is open to acquiring firms of a similar scale to its recent tech purchase.

In an interview with PTI, Infosys CEO Salil Parekh expressed the company’s interest in acquisitions within fields such as data analytics and SAAS and mentioned potential opportunities in Europe and the US.

When asked if future acquisitions might match the scale of the In-Tech deal, which was valued at 450 million euros, Parekh responded, “Absolutely. We are looking at acquisitions of that size, and with our current structure, we could manage several of them.”

In January, Infosys announced it had reached a definitive agreement to acquire 100 percent of InSemi Technology Services, a semiconductor design services company based in India. The total consideration, including earn-outs, management incentives, and retention bonuses, amounted to up to Rs 280 crore.

A bigger acquisition followed in three months.

A definitive agreement was signed in April by Infosys Germany, a wholly-owned step-down subsidiary, to purchase all 100 percent of the equity share capital of in-tech Holding, a top provider of engineering R&D services with its headquarters located in Germany, for a maximum consideration of 450 million euros, or roughly Rs 4,045 crore.

“We already have a strong presence in engineering services within Infosys, and after making two recent acquisitions in this sector—one focused on semiconductors and the other on automotive—we are very pleased with the results and see significant potential for expanding our footprint,” Parekh said.

He added that Infosys is actively looking at additional acquisition opportunities and is currently evaluating several companies.

We have a solid balance sheet and strong cash flow, and we’re now adept at integrating acquisitions across different sectors. Having completed deals in engineering services, we are now exploring opportunities in other fields such as data analytics and SAAS (software as a service) and considering possibilities in additional regions, including Europe and potentially the US,” Parekh said.

However, he noted that many factors will influence these decisions, including strategic synergies, financial considerations, cultural fit, and integration aspects.

“We are actively looking and have several opportunities in the pipeline, but these processes take time. There are many ongoing discussions about strategic fit, financial costs, cultural alignment, and integration. We will see what emerges from these discussions,” the Infosys CEO said.

When asked about the likelihood of closing more acquisitions this fiscal year, Parekh mentioned that it is challenging to provide a timeline for the outcome of current discussions.

“It’s hard to predict… we are evaluating several opportunities. However, aligning on strategic, financial, and cultural parameters, as well as integration, can be complex. While the recent acquisitions (InSemi and In-Tech) were completed relatively quickly, there were periods before that with no new deals. The process is not predictable, but the evaluations are ongoing,” he added.

According to the Grant Thornton Bharat Dealtracker Q2 2024 report, Indian deal-making involved a total of 501 deals valued at USD 21.4 billion. The report highlighted that the second quarter of 2024 saw the highest quarterly deal volumes since Q2 2022, although the total value decreased due to a lack of major merger and acquisition transactions.

The Grant Thornton Bharat Dealtracker also noted that merger and acquisition (M&A) activity in the second quarter included 132 deals worth USD 6.2 billion, showing a slight increase in deal volume but a significant 50 percent drop in value.

The report indicated that domestic deals were a major driver of growth, with volumes rising by 29 percent and values increasing 2.5 times compared to the first quarter of the year. Conversely, cross-border deals saw a decline, with volumes falling by 24 percent and values dropping by 85 percent compared to the first quarter of 2024.